how brands create value

If you want to know how brands create value, Tim Ambler, author of Marketing and the Bottom Line, put it in a very perceptive nutshell. He said that “brand equity is the UPSTREAM RESERVOIR of cash flow. Consumer motivation to buy or pay more has taken place, but hasn’t yet been translated into actual sales turnover.”

Think about that for a moment.

Connected with that thought, the brand guru Al Reis has pointed out that today, because of the information-rich environment created by social media, “products are no longer sold, they are BOUGHT”. In other words, branding “pre-sells” a product to the consumer. When he wants it, then he goes and buys it, increasingly online. That is the value of branding.

To underscore this point, all you have to do is look at the dollar value of the world’s top 3 brands, and find out what proportion of their total assets is represented by their brand value. Apple was at no.1, with its brand valued at a whopping US$145 billion – that’s 55% of its assets. Microsoft was in second place with a brand valued at over US$69 billion, which is over 40% of its total assets. Google was at no. 3 with a brand valued at just under US$66 billion, which is slightly over half of its asset value.

What’s interesting about the above three is that while product quality and innovation are key drivers of brand reputation, increasingly it is the effectiveness of the brand building itself that creates the value. Two more examples will underscore this point. As of June 2015, Manchester United became the world’s first billion-dollar football brand, and with a fan base of over half a billion in Asia alone, it was already probably the most popular football club in the world. And this despite not winning any trophies in the past two seasons, and a distinctly patchy record over the past two decades, compared to many other football clubs worldwide. Manchester United’s riches have been attributed to its flair for brand building, mainly through a mixture of sponsorship deals and retail merchandise.

And then there is the personality brand that is Donald Trump. The financial power of his brand is so great that his property projects can fail again and again, yet developers will still queue up to have his brand on their products. He doesn’t even have to stump up any cash himself – they will give him a return, largely on the terms he dictates. Such is the perceived equity in his personal brand.

But how do brands build financial value, exactly? We’ve already noted how product quality is no longer the influencer it was, although it still needs to be in the equation. Nowadays the core factor is trust, and the positive influence trust has on all the stakeholders involved with a brand, not just the customers or business partners who buy into them.

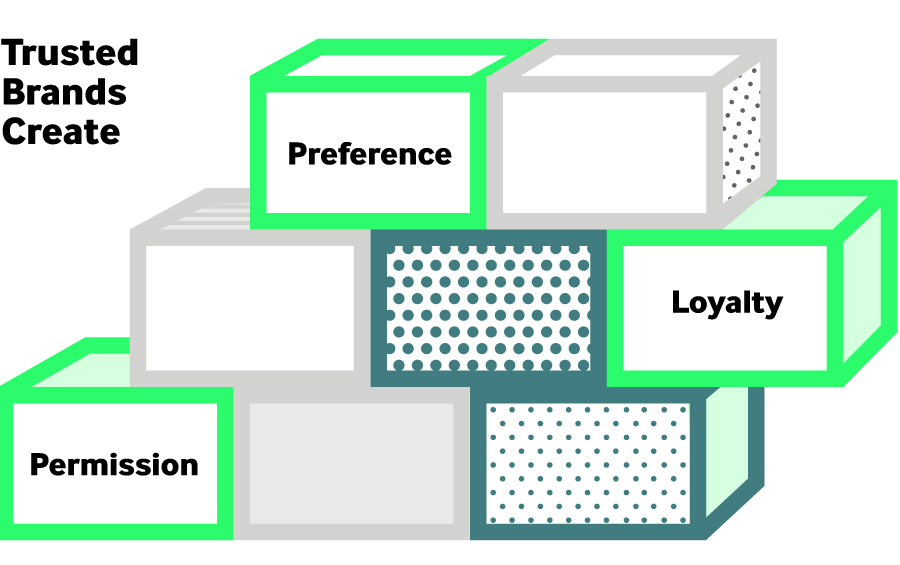

Basically, how it works is that trusted brands create:

Preference (the basis for profitability)

Permission (the basis for growth), and

Loyalty (the basis for reduced risk).

To be more specific, customers are willing to pay more for good brands, and they buy more of them. Good brands facilitate faster acceptance of brand extensions, and enable better cross-selling. Retailers stock good brands more and charge less for doing so. Employees of good brand companies stay longer and work more productively for them. Good brands attract more franchisees, and they are prepared to pay a higher proportion of their profit margin for them. Good brands lower the cost of raising loans by influencing valuations by analysts positively, and influence regulators to cut red tape and reduce set-up and running costs. And lastly, trusted brands are normally more responsible, avoiding the costly legal tangles and PR disasters associated with bad corporate behaviour.

As a result, financial markets worldwide are increasingly recognizing the contribution brands make to revenue, and the formulae they have been using to value brands are gaining widespread acceptance.

Currently there are three main brand valuation formulas being employed worldwide: the income-based brand valuation approach, the market-based approach, and the cost-based method. Without going into too much detail, essentially the income-based approach measures brand value by calculating the economic benefits expected over the life of the brand. The market-based approach measures value by referencing what other purchasers in the market have paid for similar brand assets. As for the cost-based approach, it measures value by calculating the cost invested in creating, replacing, or reproducing the brand.

While these techniques have in the past been employed as separate valuation techniques, increasingly they are being consolidated into a single valuation model that integrates income, market, and cost.

For example, leading global brand valuation consultancy Brand Finance champions a strategic brand valuation tool that consolidates market, brand, competitor, and financial data into a single, value-based framework. This framework then serves as a way of assessing the performance of the brand as well as the areas where the brand can improve in order to gain greater financial growth.

As these valuation techniques become more and more sophisticated, so the financial power of brands and their contribution to building value is becoming much better understood. So not surprisingly, more and more companies worldwide are investing much more in building and nurturing their brands.

RELATED ARTICLES